Create a Lasting Legacy

There are a number of ways you can give to the IPCC/IPEC and make a lasting impact.

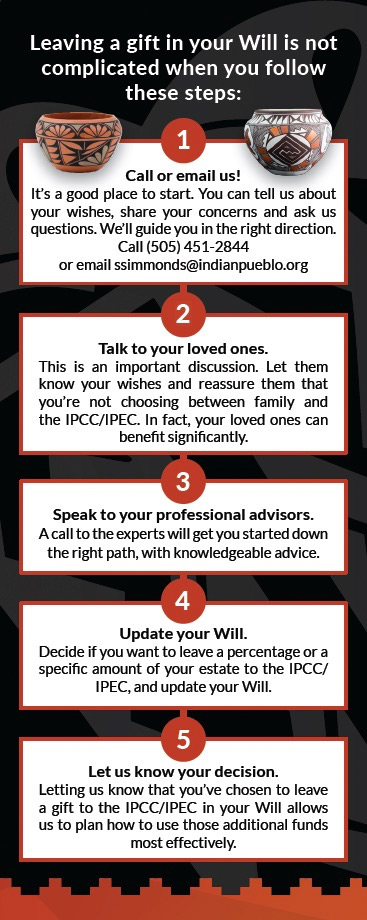

Wills – Make the IPCC/IPEC a beneficiary in your Will and know that your legacy will live on for generations. All it takes is a simple clause in your Will. Tax receipts for the amount of your donation may offset capital gains or other taxes and lessen the financial burden on your family.

Securities – A gift of securities to the IPCC/ IPEC is one of the most financially sound ways to support our programs. When you donate marketable securities, you pay no capital gains tax. You will also receive a tax receipt for the full amount of the gift.

Life Insurance – Gifts of life insurance are a great way to make a substantial donation for the relatively low cost of the premium payments. You can donate a policy you already own, make the IPCC/IPEC the beneficiary of a joint policy held with your spouse, or buy a new policy to donate.

Property – Real estate, jewelry or art can be an attractive way to make a substantial gift to the IPCC/IPEC with tax benefits by gifting the property outright, placing it in a trust to retain the use of it for life, or gifting it by Will.

Charitable Remainder Trusts – A charitable remainder trust is a separately managed trust that allows you to make a significant gift toward the future of the IPCC’s/IPEC’s work, while providing an income for yourself or loved ones. After transferring cash, securities, or other assets to a trust, a trustee invests the assets, and the trust pays income to you or to individuals you name for life, or for a set term of years. When the trust terminates, the IPCC/IPEC receives the remainder.

The trust may be a charitable remainder annuity trust (fixed payments) or a charitable remainder unitrust (fixed percentage).

Charitable Lead Trust – A charitable lead trust allows you to support the mission of the IPCC/ IPEC while safeguarding assets for your loved ones. You transfer cash, securities, or other assets to a trust. The trustee invests the assets, providing annual payments to the IPCC/IPEC for a period of time that you select. When the trust terminates, the remaining amount is paid to you or your heirs with the benefit of a reduced transfer tax.

The trust may be a charitable lead annuity (fixed payments) or a charitable lead unitrust (fixed percentage).

Benefits of a charitable lead trust:

- Reduction in transfer tax on the amount passing to your heirs

- Appreciation in trust value passes to your heirs free of gift and estate tax

- Control over when your heirs inherit trust assets

Your Support Lives on Through a Legacy Gift

We all have the power to make a difference through legacy giving. Though not all of us can make large monetary gifts during our lifetimes, almost all of us can significantly impact the organizations we care about through an estate gift.

The IPCC/IPEC supporters have the opportunity to make a generous legacy gift that has a powerful impact on the future of the IPCC/IPEC. When you include the IPCC/ IPEC in your will, trust, or other estate arrangements, your life-changing support extends well into the future.

Planned gifts are essential to the future vitality and well-being of the IPCC/IPEC. Most planned gifts, at our donors’ discretion, are invested in our Endowment Fund, providing financial support for operational and other expenses, including educational and cultural programs. Through planned giving, you are supporting the long-term sustainability for the IPCC/IPEC.

Once you’ve included the IPCC/IPEC in your estate plan, you’ll be honored and recognized as a member of our Legacy Circle.

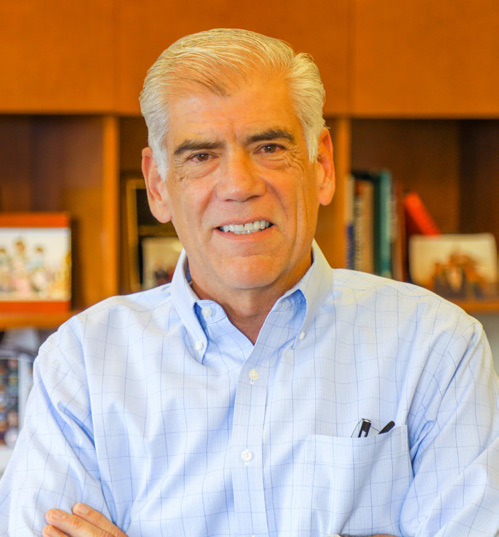

Michael G. Canfield Legacy Circle

The Michael G. Canfield Legacy Circle honors the visionaries who have included the Indian Pueblo Cultural Center (IPCC) in their estate plans, ensuring the continued celebration, preservation, and advancement of Pueblo culture for generations to come.

This distinguished Legacy Circle bears the name of Michael G. Canfield (Pueblo of Laguna), whose transformative leadership as President and Chief Executive Officer leaves an indelible mark on IPCC and its broader community. Under Canfield’s visionary guidance, the former Albuquerque Indian School campus was reimagined as a thriving hub for Pueblo business, culture, and community. His efforts in economic development and cultural preservation have elevated IPCC to a place of national recognition, creating countless opportunities for Pueblo people and contributing significantly to the economic vitality of Albuquerque and New Mexico. His enduring contributions exemplify a legacy of impact, leadership, and unwavering dedication.

By incorporating IPCC into your estate plan or by making a pledge or gift of $2,000 or more in 2025, you can join an esteemed circle of supporters dedicated to preserving Pueblo culture, advancing community development, and fostering opportunities for future generations. As a valued member of the Michael G. Canfield Legacy Circle, your profound commitment to this vital mission will be recognized and celebrated, continuing Michael Canfield’s enduring legacy.

Make a Difference for the Future

Planning your legacy is important and can be challenging. We encourage you to meet with an estate-planning attorney when preparing your will, trust, or other form of legacy agreement. Providing for your loved ones and the charities or institutions you value requires careful consideration. A gift from your estate can make an extraordinary difference to the future of the IPCC/IPEC.

To receive additional information about including IPCC/IPEC in your estate plan, please contact:

Scott Simmonds (Development Officer)

Phone: (505) 451 – 2844

Email: ssimmmonds@indianpueblo.org

The IPCC opened its doors in Albuquerque, New Mexico in 1976. Today, the IPCC continues to be a leading artistic and cultural institution, an educational resource, and a gathering place for the Pueblo people and all tribes of the Southwest. The IPCC strives to preserve and perpetuate Pueblo culture. The world-renowned exhibits receive thousands of visitors annually from around the globe and nationwide.

The IPCC/IPEC is a tax-exempt 501 © (3) organization, EIN: 85-0232968

2401 12th Street NW

Albuquerque, NM 87104

www.indianpueblo.org

(505) 451-2844